Six Ways to Detect Fraud Before It’s a Problem – A Conversation with a Fraud Investigation Expert

Fraud is a financial risk that business leaders are always up against and must continuously monitor. From phishing email scams to duplicate payments, phantom vendors, and ghost employees, fraudulent activity has evolved, requiring organizations to stay a step ahead with proactive vigilance and fraud prevention strategies. To shed some light on common fraud risks to be aware of, effective mitigation strategies, and real-world applications, we sat down with one of our fraud investigation experts, Bill Mansfield, who offered six proven strategies for detecting fraud before it starts.

Q&A with a Sirius Solutions Fraud Investigation Expert

Q: Fraud schemes are becoming increasingly sophisticated. What are the biggest risks business leaders should be watching for in 2025?

Bill Mansfield: Business leaders should pay particular attention to financial reporting misstatements, cybersecurity, phishing emails, invoice fraud, phantom vendors, ghost employees, and theft of inventory and company equipment. According to the Association of Certified Fraud Examiners (ACFE) 2024 Report to the Nations, over 80% of perpetrators exhibit these three behavioral red flags: living beyond their means, having personal financial difficulties, or having an unusually close association with a vendor or customer.

Organizations can integrate data analytics into their fraud detection efforts to identify anomalies before they escalate into major concerns.

Q: How can organizations shift from simply detecting fraud to proactively preventing it?

Bill Mansfield: Having a reactive approach to fraud detection often means financial damage has already occurred. The key to prevention lies in building strong internal controls and leveraging advanced fraud detection methodologies. Six proven best practices include:

- Good Hiring Practices with Appropriate Background Checks: Hiring good, honest employees nearly resolves internal fraudulent concerns over time.

- Segregation of Duties: Clear segregation of duties ensures no single employee has unchecked control over financial transactions.

- Automated Invoice Matching: Most modern accounting systems can compare invoices to purchase orders and identify real-time discrepancies. However, this feature has to be set up and utilized to be effective, and we often see it is not. Also, there are AI-driven tools that can be added to make this comparison.

- Continuous Auditing: Use of real-time monitoring of transactions and data analytics to detect anomalies.

- Vendor Risk Assessments: Vendors must be clearly vetted when adding them to the vendor master in the accounting system. Then, there should be periodic reviews to identify high-risk vendors and prevent unauthorized payments.

- Forensic Data Analytics: Analyzing financial transactions to identify hidden patterns indicative of fraudulent activities. We perform annual assessments of money paid for all goods and services as well as payroll for some clients. Every time we perform these engagements, we have findings and recommendations to strengthen internal controls.

By making these strategies part of your organization’s financial governance, businesses can mitigate fraud risks before they become costly problems.

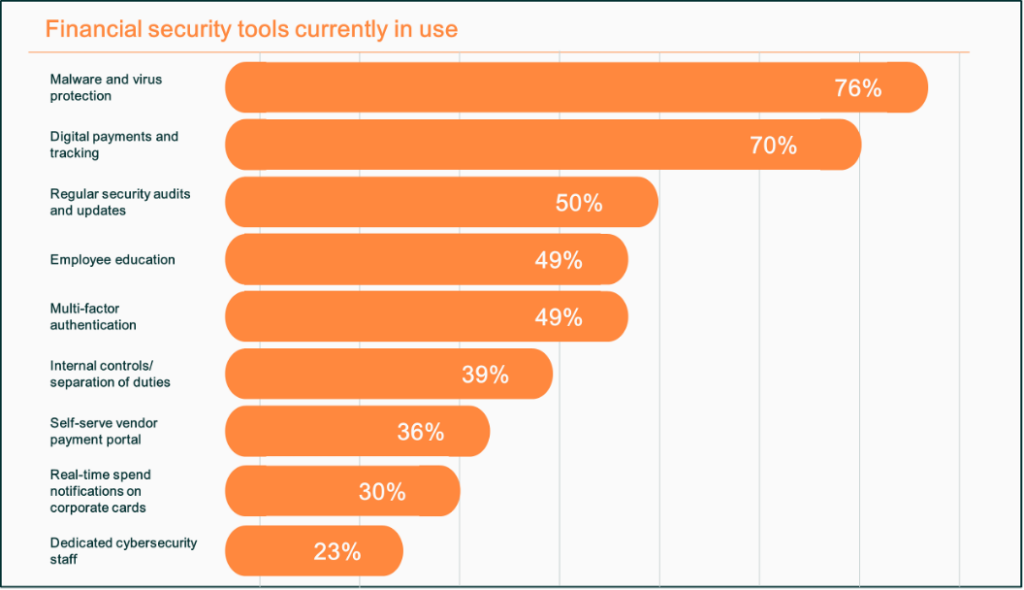

The graphic below illustrates some of the most commonly used financial security and fraud tools in organizations today. It is important to align these tools with tailored strategies to maximize their effectiveness and integrate them into your unique operational framework.

Source: The 2025 Finance Leader Outlook report. Logica Research. September 2024. Based on a market survey of 354 finance leaders in the U.S. working in accounting, finance, or C-suite roles.

Q: Can you share some real-world examples where proactive fraud detection made a difference?

Bill Mansfield: Absolutely. Here are two cases that highlight how organizations can strengthen their fraud defenses with commonly applied best practices:

Case Study 1: Investigating and Recovering Millions in Fraudulent Payments

A large construction management firm faced persistent fraud risks, including duplicate payments and falsified timesheets. Our team conducted a deep-dive investigation, uncovering $10 million in fraudulent activities and recovering $6 million. Beyond financial recovery, we helped the company tighten approval controls, redesign workflows, and train employees on fraud detection techniques. This proactive approach significantly enhanced their internal fraud prevention and detection capabilities.

Case Study 2: Strengthening Procurement and Governance Controls

A public utility company struggled with compliance gaps and inefficiencies in procurement. Through a structured fraud risk assessment, we identified vulnerabilities that had led to multiple audit findings. By implementing stronger approval processes, automating procurement workflows, and clarifying delegation policies, we helped the company reduce compliance risks and improve transparency. These changes not only reduced financial exposure but also improved operational efficiency.

Q: What’s the most important step finance leaders can take today to protect against fraud?

Bill Mansfield: The single most impactful mitigation is to foster a culture of fraud vigilance. This means providing fraud awareness training, ensuring employees understand and can identify red flags quickly, and leveraging technology for continuous monitoring. Finance leaders should also consider conducting regular internal audits and establish clear policies for financial governance. Fraud prevention is mostly about creating an environment where fraud is difficult to commit in the first place. Next to fraud prevention is having the proper controls for detecting fraud, and the training and controls should be apparent to everyone to serve as a deterrent to fraud. Perpetrators fear being caught and are less likely to commit fraud in a company with good controls.

Meet Bill Mansfield

A tenured leader, Bill launched his career with Arthur Andersen, then moved into increasingly senior roles in internal audit, business planning, and finance across the energy and utilities sector—including leadership roles at Transok, Tejas Gas, Coral Energy, and Shell. Today, Bill draws on a rare combination of operational grit, financial expertise, and client advocacy. He specializes in assessing complex business concerns, guiding clients through remediation and change, and delivering practical solutions with long-term impact.

Bill consistently earns the confidence of executive teams by delivering outcomes that align with financial priorities. His clients trust him to bring clarity, accountability, and follow-through to every engagement.

Bill shares, “Earning the trust of my clients and colleagues has been one of the most rewarding aspects of my time here, and I strive to honor that trust in every project I undertake.”

Sirius Solutions' Commitment to Fraud Prevention

Sirius Solutions partners with business leaders to implement proactive fraud prevention strategies. Our approach includes:

- Risk Identification & Mitigation: Leveraging forensic data analytics to detect and eliminate fraud risks before they escalate.

- Customized Fraud Prevention Frameworks: Tailoring fraud prevention and detection methodologies to an organization’s specific needs, from compliance risk management to internal control enhancements.

- Workforce Training & Process Strengthening: Equipping personnel with the skills needed to recognize and prevent fraudulent activities. This training brings awareness in the company, which is a strong deterrent to most would-be perpetrators, as it increases their fear of being caught.

- Rapid Expertise Deployment: With over 25 years of experience, our specialists provide strategic insight and hands-on support to fortify fraud defenses.

Final Thoughts

Fraud prevention, detection, and deterrence are an ongoing commitment to safeguarding the financial health and integrity of your organization. Sirius Solutions’ specialists are experts in their fields and global leaders with deep experience in fraud control. If your organization faces operational or financial risks and you want to improve your fraud prevention strategy, let’s work together to create a holistic plan that addresses your immediate challenges and positions you for long-term success.